With shelter-in-place (SIP) and a likely recession due to the Covid-19 coronavirus pandemic, now is the time to double down on digital marketing and sales!

With store closures, many retailers, such as Nike, are reporting Black Friday sales levels and conversion rates! And I've been seeing similar results for my clients.

In fact, in its recent quarterly report, Nike's CEO said it was able to engage its fans via its app and other digital channels while they were quarantined at home, and their free exercise services translated into strong digital sales that helped offset store closures.

Some brands or OEMs who previously had channel conflicts from wholesale/retail partners or their own brick-and-mortar stores suddenly see their direct-to-consumer channel as the only game in town during SIP.

That makes this a critical time to dig into your website and mobile app analytics!

See what part of the site is getting the most traffic, what's selling now that wasn't before, what is the makeup of the customers who are shopping now vs. before, where are users dropping off or hitting UX roadblocks?

For many of my clients, I've seen a spike in mobile web and mobile app traffic especially throughout the day and not just during commute hours. No surprise as people are home due to SIP. Also, historically, lots of office workers shop on their work desktops during the weekdays. It's not uncommon to see high conversions on Mon mornings before lunch as workers tackle their "to do" list after a relaxing weekend. But suddenly they don't have access to those work computers and must go online on their phones. So make sure your site is optimized for mobile, now more than ever!

Re-evaluate all your advertising

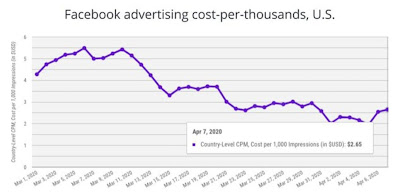

Online ad prices, especially banner, native, and video ads, that run on publisher sites are dropping as supply outstrips demand because advertisers have pulled back on spend because of SIP (e.g., travel industry can't really promote bookings), recession fears, and brand safety concerns (i.e., brands don't want their ads to show next to coronavirus content, especially on news sites). However, if you are less brand sensitive or develop a more targeted blacklisting strategy, you can make out like a bandit for your media buys. For example, Facebook CPMs have fallen to their lowest levels in 2 years.

It's also a good idea to assess the competitive media landscape. You may discover some competitors have pulled back on their paid advertising in search, display, social, video, or mobile apps. Time for you to grab market or mindshare, likely at lower ad prices as mentioned above. For some of my retail clients where Amazon used to compete with them on search, there's been less competition. Not that Amazon doesn't have the money to bid against them, but more likely because Amazon has more than its hands full now from organic traffic with everyone turning to the online retailer during SIP. (More on that below.) So check your Google Auction Insights reports. On the flip side, depending on your industry, you might see quite the opposite competitive pressure and everyone is getting more aggressive to capture as much demand as possible right now. Think about the fiercely competitive online video conferencing space right now where you have Zoom, GoToMeeting, Microsoft Teams, and Webex duking it out.

I expect performance media campaigns to see less budget cuts than branding campaigns.

Also, make sure your ad messaging is on target and appropriate for these times. For example, yesterday morning I heard a local radio ad that asked "Taking your kids to school? Listen to us in the car." Really? Schools have been closed for a month during SIP! Someone at the station clearly sleeping behind the wheel.

Take stock of and promote your most relevant product and service features during these times.

By now, as a consumer, every company has probably sent you an email and driving you to their Covid-19 landing pages to explain how they are reacting to the pandemic and SIP. And most importantly, what special services they are offering during these uncertain times.

So, as a brand, what are you going to promote?

If you have interest-free payment plans or "layaway" plans like Afterpay, it's time to promote that. Amazon features it prominently on higher ticket price items (see below). Some auto companies have rolled out 0% interest, 72-month auto loans even!

Offer curbside pickup following social distancing best practices? Promote that. Are your shipping and delivery times still unaffected? If you compete with Amazon, you may have an advantage now against the Prime shipping program as Amazon is swamped with traffic and orders, forcing them to prioritize some items over others. I don't blame them. I was about to buy an item that was eligible for Prime shipping. But at checkout, it said it won't ship for 1-2 months! That's crazy. #abandoncart

Sports retailer Sports Basement has been sending out emails that promote online events to help customers stay fit, such as live workouts with a trainer via video conference and healthy recipes to try at home (side note: there has been a spike in baking and home cooking with SIP). And of course, discounts for shopping online! Similarly, REI has 6 Ways to Mix Up Your At-Home Workday. Both are great examples of brands staying true to their brand positioning while producing relevant, engaging content for their customers.

Also, make sure you are monitoring online chatter using social media tools. How are consumers reacting to your company's response? For many brands, they are dealing with significant customer service complains on social media, online chats on their sites, and of course their call centers. But also use this data to see what's trending? How do you weave your brand into the conversation? The key is to be authentic, empathetic, and not too salesy.

Get the word out!

When you've identified relevant content to share with the community, it's time to put the CRM team and tools to work! Leverage that email database you got! For small businesses using Square, Square is offering Square Marketing, its basic CRM program I previously reviewed, for free right now. Yelp is also offering some of its premium marketing services for free for small businesses. Take advantage of these tools! Most are very easy to use without a huge learning curve.

Of course, take it to social media channels. Remember when just a few weeks ago, the government and consumer privacy advocates wanted to take down Facebook and Big Tech? Now, consumers are spending more time than ever on Facebook and almost every single social network has seen engagement shoot through the roof! When you do post, do some #hashtag research to maximize visibility.

And this goes without saying, but make sure your website can handle increased traffic, especially if you're a retailer and your stores are closed. You might also consider a code freeze like most online retailers normally do Nov-Dec. Don't risk rocking the boat when it's the only sales channel you got right now!

Lock-in long-term behavior changes

Lastly, all this time at home and SIP has forced consumers and businesses to change their behavior, largely favoring online activity, and you should take advantage of making these behaviors long term habits. Just to name a few benefactors -- online video conferencing, online banking/mobile app banking, online grocery delivery, esports, virtual medical professional services like SteadyMD or Talkspace, not to mention multi-channel retailers who have struggled to get in-store shoppers to go online or use their mobile app. Post-SIP, all these industries will benefit from an injection of new users; the key will be to keep as many as they can as paying customers for years to come.

My Covid-19 Digital Playbook:

With store closures, many retailers, such as Nike, are reporting Black Friday sales levels and conversion rates! And I've been seeing similar results for my clients.

In fact, in its recent quarterly report, Nike's CEO said it was able to engage its fans via its app and other digital channels while they were quarantined at home, and their free exercise services translated into strong digital sales that helped offset store closures.

Some brands or OEMs who previously had channel conflicts from wholesale/retail partners or their own brick-and-mortar stores suddenly see their direct-to-consumer channel as the only game in town during SIP.

That makes this a critical time to dig into your website and mobile app analytics!

See what part of the site is getting the most traffic, what's selling now that wasn't before, what is the makeup of the customers who are shopping now vs. before, where are users dropping off or hitting UX roadblocks?

For many of my clients, I've seen a spike in mobile web and mobile app traffic especially throughout the day and not just during commute hours. No surprise as people are home due to SIP. Also, historically, lots of office workers shop on their work desktops during the weekdays. It's not uncommon to see high conversions on Mon mornings before lunch as workers tackle their "to do" list after a relaxing weekend. But suddenly they don't have access to those work computers and must go online on their phones. So make sure your site is optimized for mobile, now more than ever!

Re-evaluate all your advertising

Online ad prices, especially banner, native, and video ads, that run on publisher sites are dropping as supply outstrips demand because advertisers have pulled back on spend because of SIP (e.g., travel industry can't really promote bookings), recession fears, and brand safety concerns (i.e., brands don't want their ads to show next to coronavirus content, especially on news sites). However, if you are less brand sensitive or develop a more targeted blacklisting strategy, you can make out like a bandit for your media buys. For example, Facebook CPMs have fallen to their lowest levels in 2 years.

|

| Facebook CPM Falling (Source: Gupta Media) |

I expect performance media campaigns to see less budget cuts than branding campaigns.

Also, make sure your ad messaging is on target and appropriate for these times. For example, yesterday morning I heard a local radio ad that asked "Taking your kids to school? Listen to us in the car." Really? Schools have been closed for a month during SIP! Someone at the station clearly sleeping behind the wheel.

Take stock of and promote your most relevant product and service features during these times.

By now, as a consumer, every company has probably sent you an email and driving you to their Covid-19 landing pages to explain how they are reacting to the pandemic and SIP. And most importantly, what special services they are offering during these uncertain times.

So, as a brand, what are you going to promote?

If you have interest-free payment plans or "layaway" plans like Afterpay, it's time to promote that. Amazon features it prominently on higher ticket price items (see below). Some auto companies have rolled out 0% interest, 72-month auto loans even!

|

| Amazon's interest-free payment plan |

Right now consumers are very concerned about supporting small businesses who risk going under. For smaller businesses who are reaching out to their community for help, now's a good time to setup and promote online gift cards. Square, which is quite popular with small businesses, has even created a Give & Get Local site to make it easy for local merchants to promote their e-gift cards to consumers. I've seen when merchants promote this in email campaigns, consumers are buying them to keep their favorite businesses afloat, hoping to patronize them later when we get through this. Facebook is also offering small businesses grants.

Offer curbside pickup following social distancing best practices? Promote that. Are your shipping and delivery times still unaffected? If you compete with Amazon, you may have an advantage now against the Prime shipping program as Amazon is swamped with traffic and orders, forcing them to prioritize some items over others. I don't blame them. I was about to buy an item that was eligible for Prime shipping. But at checkout, it said it won't ship for 1-2 months! That's crazy. #abandoncart

Sports retailer Sports Basement has been sending out emails that promote online events to help customers stay fit, such as live workouts with a trainer via video conference and healthy recipes to try at home (side note: there has been a spike in baking and home cooking with SIP). And of course, discounts for shopping online! Similarly, REI has 6 Ways to Mix Up Your At-Home Workday. Both are great examples of brands staying true to their brand positioning while producing relevant, engaging content for their customers.

|

| Sports Basement workout tip |

Get the word out!

When you've identified relevant content to share with the community, it's time to put the CRM team and tools to work! Leverage that email database you got! For small businesses using Square, Square is offering Square Marketing, its basic CRM program I previously reviewed, for free right now. Yelp is also offering some of its premium marketing services for free for small businesses. Take advantage of these tools! Most are very easy to use without a huge learning curve.

Of course, take it to social media channels. Remember when just a few weeks ago, the government and consumer privacy advocates wanted to take down Facebook and Big Tech? Now, consumers are spending more time than ever on Facebook and almost every single social network has seen engagement shoot through the roof! When you do post, do some #hashtag research to maximize visibility.

And this goes without saying, but make sure your website can handle increased traffic, especially if you're a retailer and your stores are closed. You might also consider a code freeze like most online retailers normally do Nov-Dec. Don't risk rocking the boat when it's the only sales channel you got right now!

Lock-in long-term behavior changes

Lastly, all this time at home and SIP has forced consumers and businesses to change their behavior, largely favoring online activity, and you should take advantage of making these behaviors long term habits. Just to name a few benefactors -- online video conferencing, online banking/mobile app banking, online grocery delivery, esports, virtual medical professional services like SteadyMD or Talkspace, not to mention multi-channel retailers who have struggled to get in-store shoppers to go online or use their mobile app. Post-SIP, all these industries will benefit from an injection of new users; the key will be to keep as many as they can as paying customers for years to come.

My Covid-19 Digital Playbook:

- Dig into your web + app analytics data for insights

- Re-evaluate your media buys and messaging

- Develop relevant content for Covid-19 behaviors due to SIP and be useful to consumers

- Be active on social media and email channels

- Be prepared for how to exploit long-term behavior changes after we get through this to capitalize on your short-term wins

Now I only wish there was a digital solution for haircuts because I need one badly! =( And I don't just mean an AR filter for my video calls or socialpost!

Stay safe and sane out there...

##